Pound for Pound, Taiwan Is the Most Important Place in the World

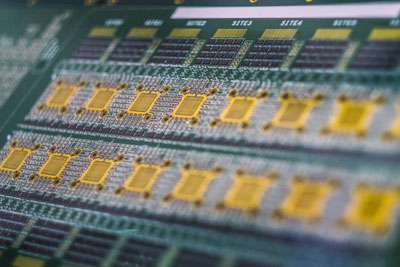

Over the past year, Taiwan has taken a lead in the race to build thinner, faster and more powerful chips, or semiconductors. Its fastest chips are the critical building blocks of rapidly evolving digital industries like artificial intelligence and high-speed computing. The thinnest chips will be powering the coming "internet of things," in which homes, cars, appliances and even clothes will connect to smartphones and voice-activated speakers over 5G networks. As of now, any country looking to dominate the digital future has to buy these superfast, ultrathin chips from either Taiwan or South Korea. And Taiwan has the edge in both technology and market power. It is a small island of just 24 million people, but it is at the center of the battle for global technological supremacy. Pound for pound, it is the most important place in the world. As the Cold War between China and the United States intensifies, that importance will only continue to grow. After World War II, only two major emerging economies managed to grow faster than 5 percent for five decades in a row and to rise from poverty into the ranks of developed economies. One was Taiwan, the other South Korea. They kept advancing up the industrial ladder by investing more heavily in research and development than did any of their rivals among emerging economies. Now they are among the research leaders of the developed economic world as well. How did they accomplish this feat? Competent governments played a major role. South Korea nurtured giant conglomerates like Samsung and Hyundai, which exported consumer products under their own brand names. Taiwan cultivated smaller companies focused on making parts or assembling finished products for foreign brands. Today the flexibility goes a long way toward explaining its success. Taiwan always managed to stay near the cutting edge, at first by borrowing technology from Western nations. As early as the 1970s, electronics had replaced textiles as its leading manufacturing industry. Through every phase of the computer revolution, from PCs to software to the mobile internet, Taiwanese factories managed to retool fast enough to remain important global suppliers. Inspired by Silicon Valley, Taiwan's government in 1980 set up the first of its science parks. Each park would have its own tech-focused university, and the government offered bonuses for Taiwanese-born engineers to return home from other countries to work there. Mixing overseas experience with young local graduates, the science parks became hothouses for entrepreneurial start-ups. A few start-ups went on to become giant companies, though still relatively unknown to the global public. By the 2010s a Taiwanese company, Foxconn Technology, was assembling 40 percent of the world's consumer electronic products, using plants in Asia, Europe and Latin America. Today Taiwanese companies are major suppliers of a wide range of parts — smartphone lenses, e-paper displays — and the indispensable suppliers of computer chips. One of the Taiwanese government's early star recruits was Morris Chang, a graduate of the Massachusetts Institute of Technology and a veteran of Texas Instruments. Tasked with building a semiconductor industry, Mr. Chang reviewed Taiwan's strengths and weaknesses, and rejected the idea of trying to go head-to-head with global brands like Intel. Instead, he built the world's first chip foundry, Taiwan Semiconductor Manufacturing Company, or T.S.M.C.  Billy H.C. Kwok/Bloomberg, via Getty Images Much like the Taiwan contract manufacturers that once made toys and textiles, a "pure foundry" like Mr. Chang's stayed in the background, cranking out chips for global brands rather than its own devices. Today foundries are a small corner of the $430 billion global chip market, but all of the most advanced chips come from foundries. And two-thirds of foundry production comes out of Taiwan, most of it from T.S.M.C. Intel fell behind the leaders this year because of production delays. That left only two real competitors standing: Samsung and T.S.M.C. Both introduced five-nanometer chips this year and plan to introduce the first three-nanometer chips in 2022. Going forward, many tech analysts predict that Taiwan's business model gives it a clear edge. Most customers prefer a pure foundry that does not compete with them to design chips or build devices, and only Taiwan offers this service. That is a big reason Apple has been switching from Samsung to T.S.M.C. for the processing chips in the iPhone and why Intel is expected to outsource production of its most advanced chips mainly to T.S.M.C. Taiwan has tried to position itself as the "Switzerland" of chips, a neutral supplier, but it increasingly finds itself at the center of the jousting between China and the United States. U.S. sanctions against China's leading smartphone maker, Huawei, were designed in part to block Huawei's access to chips from T.S.M.C. Beijing responded by accelerating a campaign to build its own advanced chip plants on Chinese soil. And the Trump administration countered by inviting T.S.M.C. to build a U.S. chip fabrication plant, which will be in Arizona. In this contest, it is not clear which superpower has the upper hand. China still relies more heavily on imports and foreign technology, but the United States is investing less aggressively in local production, and the Arizona plant won't be nearly big enough to fill the gap. Unlike Taiwan's other factories, which are scattered worldwide, its chip fabrication plants are concentrated on its home island, just 100 miles off the mainland coast of China. In the event of military conflict or rising tension, U.S. access to those chip fabrication plants could be vulnerable to missile threat or naval blockade. Historically, the importance of Taiwan was calculated in geopolitical terms. A small democracy thriving in the shadow of a Communist giant stirred sympathy and support in Washington. Now, as a byproduct of its successful economic model, Taiwan has become a critical link in the global tech supply chain, adding economic weight to the geopolitical calculations. And that weight is likely to increase as the battle for global tech supremacy heats up. Data Source: The New York Times |

|||

|

|

|||